The government will pay a larger share of workers’ wages to protect companies struggling with Covid-19 restrictions under the Job Support Scheme (JSS)

The British chancellor, Rishi Sunak, has announced a last-minute change in the new government’s new job support scheme ( JSS) which will now benefit most of our customer and other UK businesses.

The system was designed to help companies suffering a fall in business during the pandemic and needing to put staff on reduced hours to save money.

The Job Support Scheme will be open from 1 November 2020 and run for 6 months, , until 30 April 2021.

Eligibility criteria

Employers can only claim for employees that were in their employment on 23 September 2020. This means an RTI Full Payment Submission notifying payment in respect of that employee must have been made to HMRC at some point on or before 23 September 2020.

Employees can be on any type of contract, including zero hours or temporary contracts.

Employees do not need to have been furloughed under the Coronavirus Job Retention Scheme to be eligible for the Job Support Scheme.

Employers will be able to top up employee wages above the level of minimum contributions at their own expense if they wish.

Employers cannot claim both JSS Open and JSS Closed in respect of a single employee for the same day.

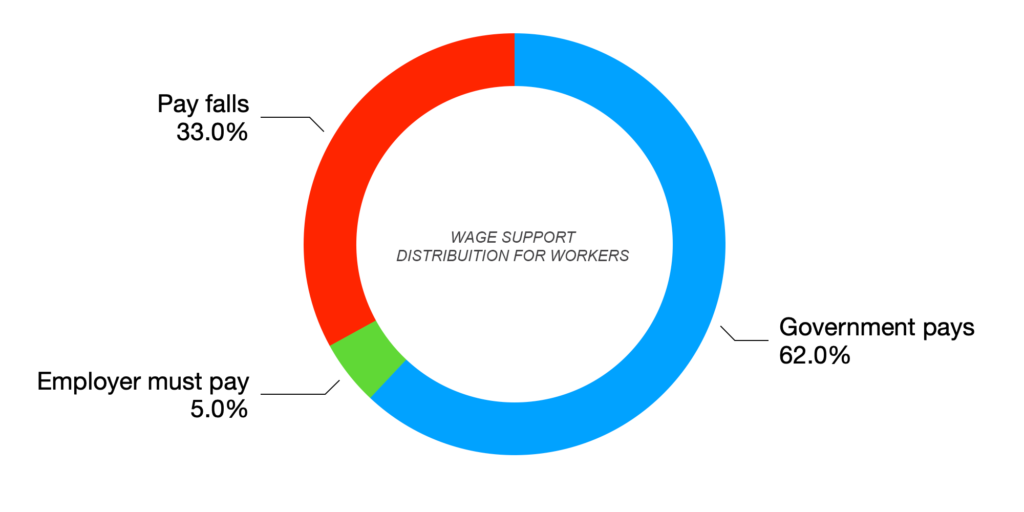

What has changed?

Under the new system announced an employee now needs to only work 20% of their usual hours to benefit from the JSS. The government has also cut the level of employer contribution to just 5%. This means the government will pay 62% of a worker’s wages ( salary with a discounted rate of 33 %).

Under JSS, employers can claim for this government support for their employee wage ( including employees on National Minimum Wage ) up to £ 1,541.75 per month, depending on how many hours they work.

Claim period start from 1 November 2020 onwards. Claims are subject to a maximum reference salary of £ 3,125 per calendar month.

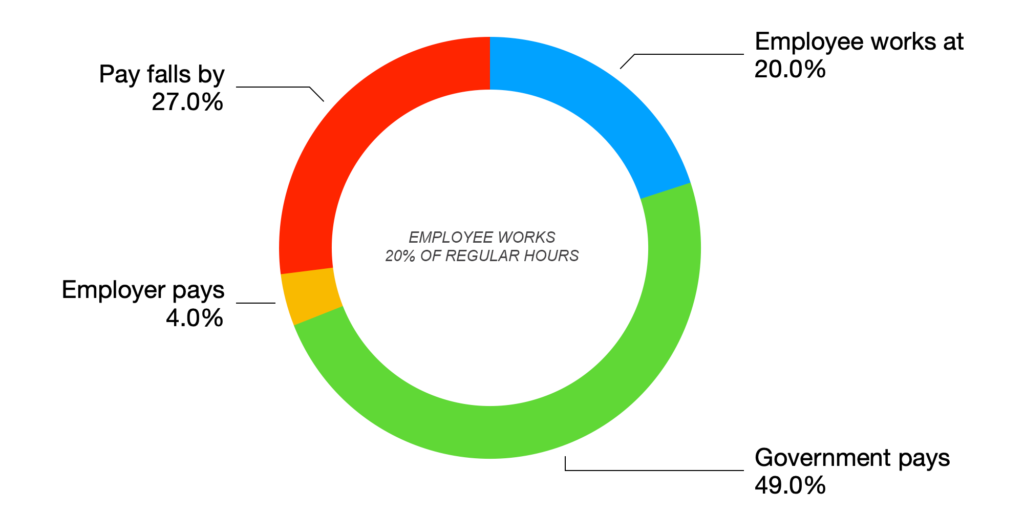

Let me give you an example if your employee will be start working 20 % ( out of a full salary of £ 2,000 – 40 hours per week)

Please check the picture below :

New part time JSS ( working at least 20% of hours )

With the new change announced , all businesses can currently take advantage of this new part-time JSS.

Summary of new part time JSS:

Employee must work at least 20 % of working hours .

The Government will 49 % ( 61.67 % x 80% ) of employee total salary.

Employer will pay 4 % ( 5 % x 80 % ) of employee total salary..

Let me give you an example :

Total current employee salary £ 2,000 ( works 40 hours per week )

Employee works 20 % under the new part time JSS = 8 hours per week

Total employee salary under the new part time JSS = £ 1,460.00

Government pays £ 980,00 ( 49 %)

Employer pays £ 80,00 (4%)

Employer pays £ 400,00 (20%)

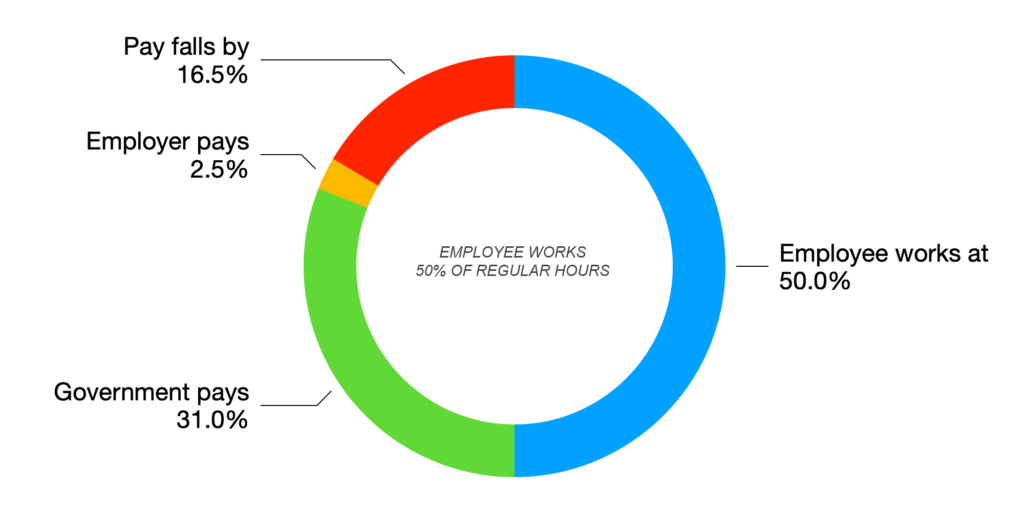

Let me give you another example below :

Let me give you an example if your employee will be start working 50 % ( out of a full salary of £ 2,000 – 40 hours per week)

Please check the picture below :

New part time JSS ( working at least 50% of hours )

With the new change announced , all businesses can currently take advantage of this new part-time JSS.

Summary of new part time JSS:

Employee work 50 % of working hours .

The Government will 31 % ( 61.67 % x 50% ) of employee total salary.

Employer will pay 2.5 % ( 5 % x 50 % ) of employee total salary.

Let me give you an example :

Total current employee salary £ 2,000 ( usually works 40 hours per week )

Employee works 50 % under the new part time JSS = 20 hours per week

Total employee salary under the new part time JSS = £ 1,670.00

Government pays £ 620,00 ( 31 %)

Employer pays contribution of £ 50 (2.5%)

Employer pays £ 1,000,00 (50%)

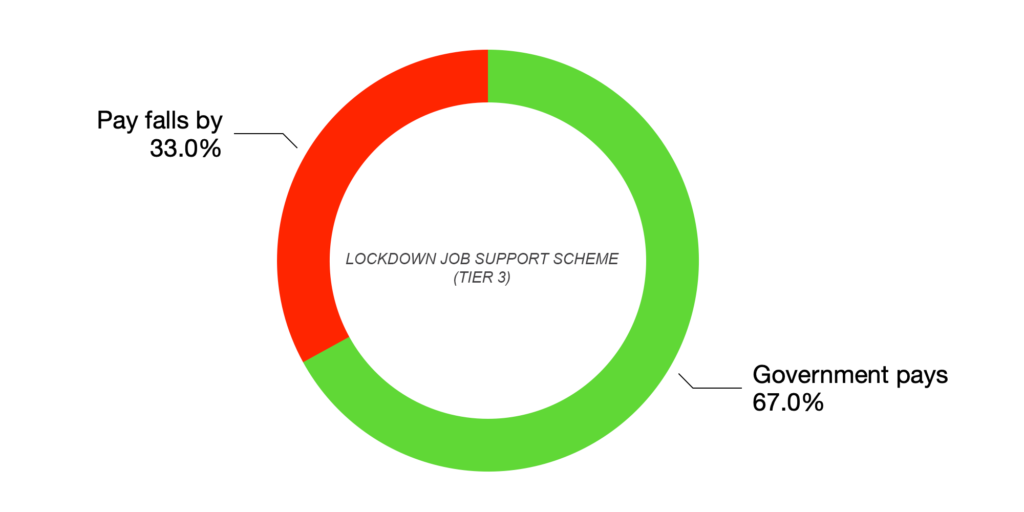

JSS if business is in tier 3 ( business forced to close )- know as job support scheme : closed

Sunak announced an expansion of the JSS earlier this month for businesses in “very high” tier 3 alert level areas which have been forced to close their doors.

Known as the “job support scheme: closed” the system of wage subsidies is different from the “job support scheme: open” because it requires no contribution to be made to workers’ wages from businesses. It also does not require an employee to work a minimum number of hours.

Under the JSS: closed, the government will pay two-thirds (67%) of a worker’s usual wages. Employers pay no wages, although must still pay national insurance and pensions contributions.

Summary of new job support scheme closed :

Employer pay no wages.

The Government will 67 % of total salary ( with salary discounted of 33% )

Let me give you an example :

Total current employee salary £ 2,000 ( shop if closed )

Government pays £ 1,340,00 ( 67 %)

Paying employees taxes and pensions contributions

The job Support scheme grant will not cover National Insurance contributions ( NICs) or pension contributions. These contributions remain payable by the employer.

Employers must deduct and pay to HMRC income tax and employee NIC s on the full amount that is paid to the employee, including any amounts subsequently met by a scheme grant.

Employers must also pay to HMRC any employer NICs due on the full amount that is paid to the employee, including any amounts subsequently met by a scheme grant.

Employers must have paid the full amount claimed for an employee`s wages to the employee before each claim is made.

Get ready to claim

Employers will be able to make their first claim from December 2020 . Employers will be able to claim from 8 December, covering salary for pay periods ending and paid in November.

Subsequent months will follow a similar pattern, with the final claims for April 2021 being made from early May 2021.

Vertice Services are authorised to do PAYE online for our customers and we will be also able to claim on your behalf.

How much will cost you?

Our fees per claim submission are as following:

• £75.00/submission – 1 employee (including if the sole employee is the director)

• £120.00/submission – 2 employees – (including directors)

• £180.00/submission – from 3 up to 5 employees – same as above

• £300.00/submission – from 6 up to 10 employees – same as above

• £375.00/submission – from 11 to 20 employees – same as above