Budget 2021: Key points at-a-glance

Chancellor Rishi Sunak has unveiled the contents of his Budget in the House of Commons. An extension to the Chancellor’s flagship furlough scheme and more coronavirus support dominated one of the most anticipated Budgets in recent memory. Here’s a summary of the main tax and business measures. This guide will be added to over the […]

Has your business in the UK been financially affected by Coronavirus (COVID-19)? What kind of support is available to you?

On 11th March and on 17th March 2020, The Chancellor has announced a package of temporary measures to support businesses, especially small and medium Enterprises. Follow below a summary of these support measures: Statutory Sick Pay (SSP): The government will allow Employers to reclaim Statutory Sick Pay ( SSP) paid for sickness absence due to […]

Important notice: New VAT Flat Rate Scheme

From April 2017, HMRC has announced significant changes for the amount of VAT that many small businesses will have to pay in UK. This will affect vast majority of businesses that use the VAT Flat Rate Scheme but spend very little on goods, including raw materials such as companies providing services to their clients. The […]

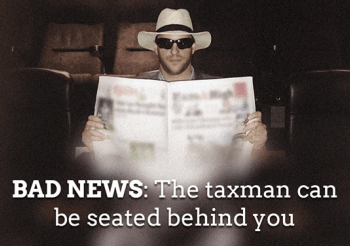

HMRC IS CLOSING THE NET ON TAX DODGERS

This HMRC advert is one of many the government has placed in public spaces. This initiative is called “HMRC is closing the net on tax dodgers”. The message is clear: ‘We are coming after you if you don’t pay your taxes’.As soon as I arrived in the cinema I went to buy myself popcorn and […]

MTD – Important Matter About Your Business and How Vertice Can Help You

MTD will change the way you manage your business. Get in touch for more info about how we can help you move to online accountancy seamlessly: 0207 328 8338 or info@verticeservices.com

‘HMRC’ tax refund fraud: beware of phishing emails

Fake ‘HMRC’ tax refund emails are once again flooding inboxes. We’ll show you how to spot a fake tax rebate email. According to Wikipedia, “Phishing is the attempt to obtain sensitive information such as usernames, passwords, and credit card details (and money), often for malicious reasons, by disguising as a trustworthy entity in an electronic communication“. And the time when bogus emails were poorly […]

Updated Spring Budget 2017 – Self-employed will no longer pay the bill. Small Business owners will.

On 8th March 2017, Philip Hammond, the Chancellor of Exchequer delivered his first and last Spring Budget (as from next year the Government will only delivery one Budget per year and it will delivered in the autumn season).The Spring Budget was very short in comparison with previous ones with only 28 main announcements. Philip Hammond […]

BEWARE OF FAKE HMRC NOTICE ABOUT TAX REFUND

We are aware that some of our clients have received text messages and/or emails promising tax refunds. These messages, supposedly sent by HMRC, are fraud.Do not disclosure any personal information via SMS, email of phone in reply to these messages (examples below). HMRC is aware of the situation and stated:“HMRC will never notify you of […]

BUDGET APRIL 2016

The Chancellor has presented his Budget to Parliament on 16th March 2016.During the Budget speech Mr. Osborne has promised many times to “put the next generation first”.Here’s a summary of what was announced: According to Mr Osborne UK should remain in EUMr Osborne flagged up the OBR comment in its economic forecast: that “a vote […]